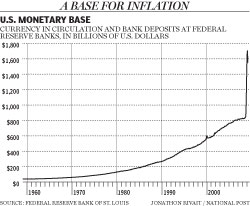

Terence Corcoran recently wrote about how the United States is fabricating more currency in order to assist itself in buying back some outstanding debt. At best, this is a silly as when people have tired to keep their credit card debt cycling from one card to another: yes, it works at first until no one wants to deal with how many lines of credit you have open and they offers stop coming. Of course with the U.S. the ‘offers’ do not come from outside companies, but from our ability to mint or otherwise produce our own currency. The obvious problem with this approach should be obvious: If when we had $100 floating as a total of US currency, $1 used to buy product A, and now there’s $200 out there, odds are the price of Product A will rise. Perhaps product A will not rise to $2 due to the fact that the new increase of dollars isn’t spread evenly across those who may be willing to purchase product A, but it will rise accordingly to meet the demand. It may rise MORE than expected as well if there is concern that more currency will be minted or that there may be a financial panic on the horizon due to this action.

Look to see how much banks begin to raise their rates as well if they see any chance of inflation on the horizon. Part of their equation for lending is to make sure that they equal or beat the rate of inflation over the time of the loan and if this injection of currency throws off their projections then it will not matter how low the Fed makes any of their rates, the banks will adjust their own accordingly.

Of course, in the short term, this now reduces the amount of our own nation debt as a proportion of how much currency there is and since the government takes initial posession of the money it would be easier to pay downt he debt with this fresh currency, but as stated, once everyone knows exactly how much new currency there is and where that currency is headed all parties will adjust their terms accordingly — including rasing their rates against US debt or being unwilling to lend at all. Odds are that it will not come to the extreme since the US is such a large consumer, but it is good to remember that we are also a debtor nation so while adds are not in favor of that happening, someone may do a call on us and force our hand.

What do the powers that be in Washington D.C. think about all this? I’m uncertain that they have given it much thought. Perhaps they are complicit in it as Mr. Corcoran suggests, “The AIG bonus firestorm is a diversion from real issues , but it puts the ghastly political classes who make U.S. law on display for what they are: ageing self-serving demagogues who have spent decades warping the U.S. political system for their own ends. We see the system up close, law-making that is riddled with slapdash, incompetence and gamesmanship.”

To close it seems most fitting to let Mr. corcoran have the final say, “Reform of health care, environmental policy, education, energy, banking, regulation — every nook and cranny of the U.S. economy has been put on alert for major change. Expansion of government spending, plunging the U.S. into unprecedented deficits, is without parallel. In economic policy, through regulation and control of energy output, financial services and monetary expansion, the U.S. government has embarked on a fundamental reshaping of America. It is designed, in short, to bring on the end of America.”